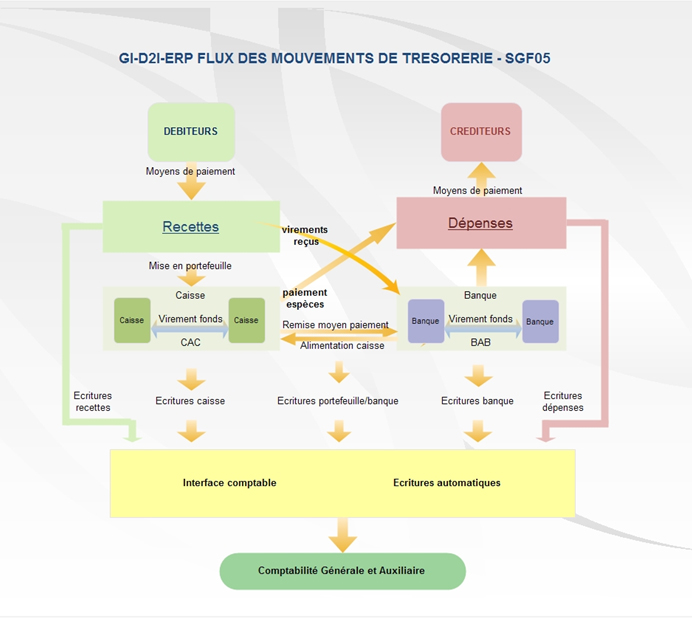

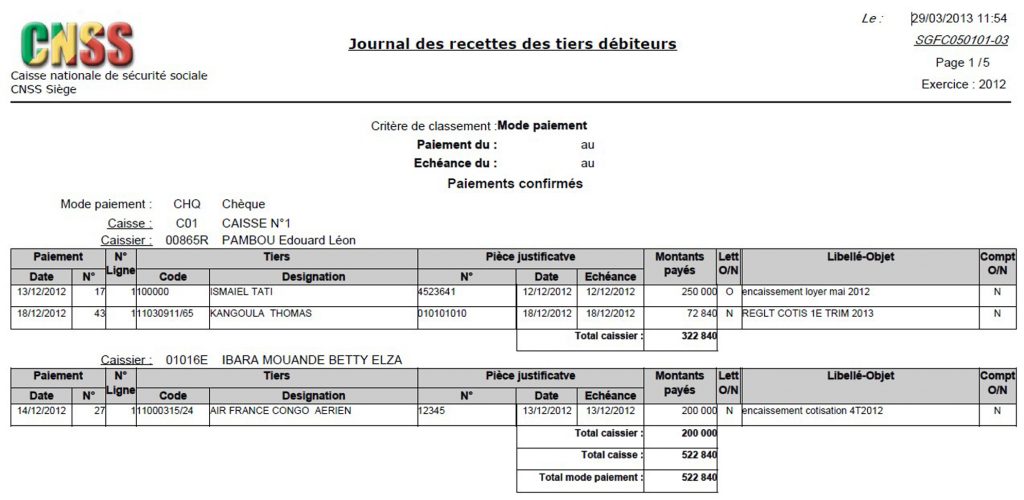

Handling the receipts :

The up-load of receipts is done at the front-office or in the back-office with or without automatic cross-checking.

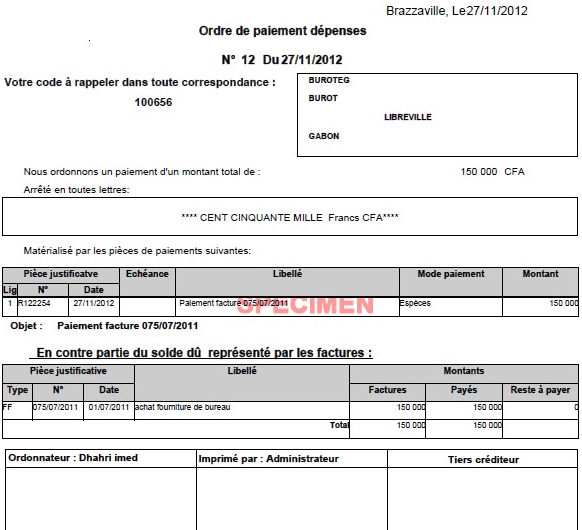

Handling the expenses :

The payments are up-loaded in sequence with or without automatic cross-checking and issuing receipts.

Schedule of payments :

Track and reminders of term commitments.

Cash transactions :

- Management of the cash transactions : expenses and receipts

- Cash closing, cash login and check, replenishment, carrying forward the balances, cash securities tracking

- Issuance of receipts.

Processing of banking relations :

Banks transactions from processing to automatic reporting: Assets deposit, charge backs, transaction notice, transfers, etc.

Withholdings management :

(Guarantees, taxes, etc.) with prints of adequate certificates and follow up per due date.

Up-load and track of bank guarantees

Production of the cash-flow tables

|

|